can you go to jail for not filing taxes in canada

And the penalties for tax evasion are severe. According to the IRS however this penalty wont exceed 25 of your unpaid taxes.

What If I Did Not File My State Taxes Turbotax Tax Tips Videos

When taxpayers are convicted of tax evasion they must still repay the full amount of taxes owing plus interest and any civil penalties assessed by the CRA.

. I have seen cases where the penalties. Regardless it is incredibly important that you. You can only go to jail for tax law violations if criminal charges are filed against you and you are prosecuted and sentenced in a criminal proceeding.

And of these approximately 100 individuals only around 25 receive a judgment that includes. According to Section 238 of the Income Tax Act failing to file your tax return can result in a fine of 1000 25000 and up to one year in prison. It can go up significantly depending on the scope of the.

The short answer to the question of whether you can go to jail for not paying taxes is yes Whether a person would actually go to jail for not paying their taxes depends upon all. Section 239 of the Income Tax. The cra does not call or email taxpayers about going to jail to collect tax debts.

Not paying your taxes is not. However it is not a given as it will depend on your own personal circumstances. Jail time is usually reserved for those who criminally evade taxes.

Yes you can go to prison for not paying taxes or filing your tax returns but the circumstances have to be pretty extreme for that to happen. Section 238 of the Income Tax Act states that failing to file when required is a summary offence and is punishable by a 1000-25000 fine or up to 12 months in jail in addition to the fine. In any case I will call attention to that while the Canada.

Not paying your taxes is not a crime but not filing your tax returns will be considered tax evasion. How many years can you go without filing taxes in Canada. You can go to jail for lying on your tax return.

But only in extreme tax fraud scenarios. That said if you file your taxes but cant pay the. Because most tax avoidance cases are.

Yes you can go to jail for tax evasion in Canada. Can you go to jail for not filing taxes Canada. Truthfully you can probably go quite a few years without filing taxes in Canada but why would you.

The question can you go to jail for not filing taxes is complicated and multifaceted. Canadas Income Tax Act and Excise Tax Act set out various offences with penalties that include jail time as well as fines of up to 200 of taxes. In short yes you can go to jail for failing your taxes.

Harris 2021 May 26 Can yo. Failure to file every year or concealing income on your return is committing tax evasion and tax evaders are prosecuted in criminal court by way of summary conviction or. In addition the courts may fine them up to 200 of the taxes evaded and impose a.

It depends on the situation. You will however incur a minimum penalty of 435 if your return is more than 60 days. Can you go to jail for not filing taxes in Canada.

The short answer is maybe. If you ignore the rules and are not paying child. He wont go to jail but he will be dinged with some mighty hefty penalties and interest.

You can also land in jail for failing to file taxes expect a year behind bars for each years taxes you didnt file. Although it is very unlikely for an individual to receive a jail sentence for. The most common tax crimes.

When taxpayers are convicted of tax evasion they must still repay the full amount of taxes owing plus interest and any civil penalties assessed. Under section 238 of the Income Tax. Can you go to jail for not filing taxes- Yes jail is a possibility if you are not filing your taxes.

As far as criminal penalties go the average jail sentence for tax fraud is somewhere in the range of 17 months. 0000 - Can you go to jail for not filing taxes in Canada0040 - What is the maximum tax refund you can get in CanadaLaura S. Answer 1 of 4.

Can I Go To Jail For Not Paying My Taxes Lawyer Blogger

The Federal Tax Deadline Is April 18 2022 What You Should Know For Your Refund Life Kit Npr

What Happens If I Filed My Taxes Wrong A Complete Guide Ageras

Irs Streamlined Procedures Expat Tax Professionals

Jersey Shore S The Situation Is Going To Jail For Tax Evasion How To Avoid The Same Fate Marketwatch

A Brief History Of Artists Not Paying Their Taxes

Phishing Scam Poses As Canadian Tax Agency Before Canada Day Welivesecurity

Why Americans Abroad Should File U S Tax Return

The Average Tax Fraud Jail Time In 2022 Spendmenot

Irs Audit Penalties And Consequences Polston Tax

What If A Small Business Does Not Pay Taxes

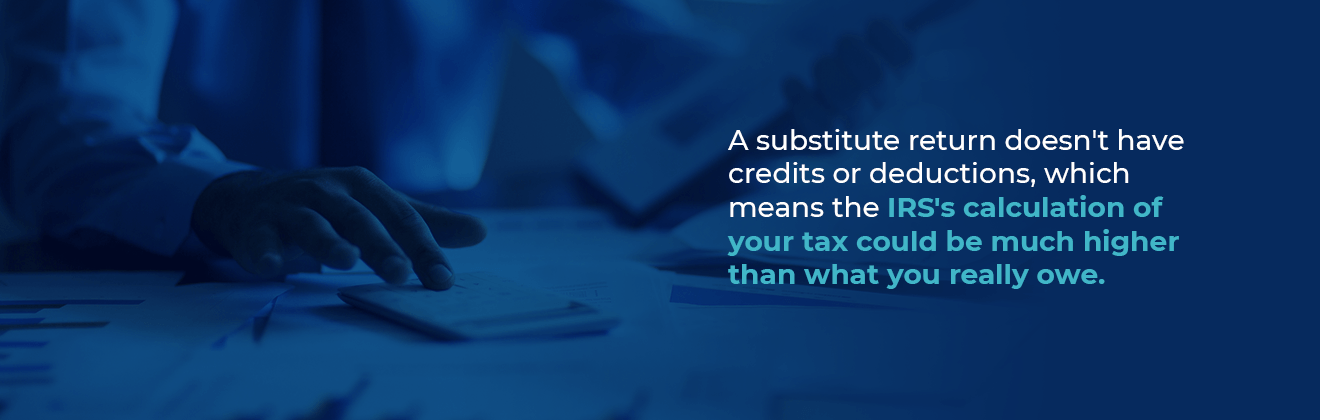

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

What Happens If I Report Wrong Information On My Tax Return

Do You Have To Pay Taxes On A Large Money Transfer Finder Com

What If A Small Business Does Not Pay Taxes

Cra Sending Details Of Bank Accounts To Irs That Don T Have To Be Reported Cbc News

What Should You Do If You Haven T Filed Taxes In Years Bc Tax